Investigative Research

Go beyond

the numbers

While many are judging their managers by hindsight performance and luck, BlueOnion seeks to confirm that managers are walking their talks and are exercising best stewardship for the investors' capital.

BlueOnion's advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly and easily. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on an unmatached universe of 300,000 active, passive funds and ETFs and 40,000+ companies, using 250 ESG metrics from 30,000 sources in over 100+ countries.

Fundamentals & Profiling

Sustainability Rankings & Scoring

Qualitative Scoring & Assessment

Monitoring & Intelligence

Fundamentals & Profiling

Comprehensive & Timely

Data to fuel your research

BlueOnion allows you to focus your quantitative searches and let you drill down to the constituents of the entire portfolio to preview the companies weighting, sustainability scoring and fundmentals.

Constituents Drill Down

Holdings

Gives you the full holdings of each strategy and their market caps, exchanges, industries, plus their ESG, GC, and temperature exposures.

Portfolio Fundamentals

Fundamentals

The Fund level P/E, P/B, relative strength, price momentum, the managers and their tenure, turnover, etc.

Peer Comparison & Analysis

Analysis

Allows you to compare funds of the same type over 50 KPIs, including investment styles, ESG, UN Global Compact and temperature alignment.

Style & Objective Searches

Objectives

Filter funds from 9 investment styles, and over 60 investment objectives, including risk and return, ESG inclusion, countries exclusions, etc.

Sustainability Rankings

Risk Exposures in

ESG, GC and Temperature

Hold managers accountable with their ESG strategies by analyzing their sectors, industries, investment and divestments actions to validate that they’re following their stated ESG integration philosophies. The data-driven process for outcomes reflects how they’ve taken materiality issues of specific ESG issues into their investment processes.

ESG Screening

ESG Screening

Featuring 33 ESG topics in emissions, biodiversity, water, environmental stewardship, diversity, product safety, shareholders' rights, forensic accounting...

Involvement

Preferences

Set tolerance for 33 personal preferences, including thermal coal, alcohol, adult entertainment, firearms, fossil fuel, tobacco, GMO, gambling, etc.

Temperature

Temperature

Measure funds' global warming in 5 climate impact indicators, including near-term and long-term Temperature score, Target, Scope 3, and Trend.

Global Compact

Global Compact

Responsible businesses enactment towards the United Nation’s GC goals for human rights, labor rights, environmental, and anti-corruption.

Qualitative Assessment

Five Pillars for

Manager Selection

The tool leverages drills deeper into a strategy. It quantifies the 41 Qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. The feature layer aggregates hundreds of inputs along the five critical pillars of a fund’s qualitative strength, rather than relying on hindsight and past performances.

01. Investment Process

Process

7 features 27 attributes of team’s idea generation, principles, investment style, accountability, ESG material consequences, market response...

02. Portfolio Construction

Portfolio

7 features 17 attributes of construction principles, portfolio limits, liquidity capacity, investment and divestment bases, resources, security weight...

03. Performance & Risk

Performance

6 features 30 attributes of performance risks, alpha sources, investor diversification, net returns, drawdowns, recovery, stress testing...

04. Stewardship Practice

Stewardship

5 features 32 attributes of the manager’s engagement frequency and disclosure, stewardship principles, voting policies and disclosures, responsible shareholding...

05. Corporate Quality

Stewardship

13 features 52 attributes to reflect the parent's transparency on key-man events and material redemptions, AUM change, compliance and reporting protocol, skin in the game...

Gatekeeper Register

Exclusive Platform

For Manager Intelligence

A comprehensive library to feature the best-of-the-best managers and strategies selected by a prestigious panel of gatekeepers. The Gatekeeper Register is also a live forum where interviews with Fund Managers and CIOs are held annually in different time zones allowing asset owners and due diligence personnel to conduct a deeper analysis of the team and the strategies.

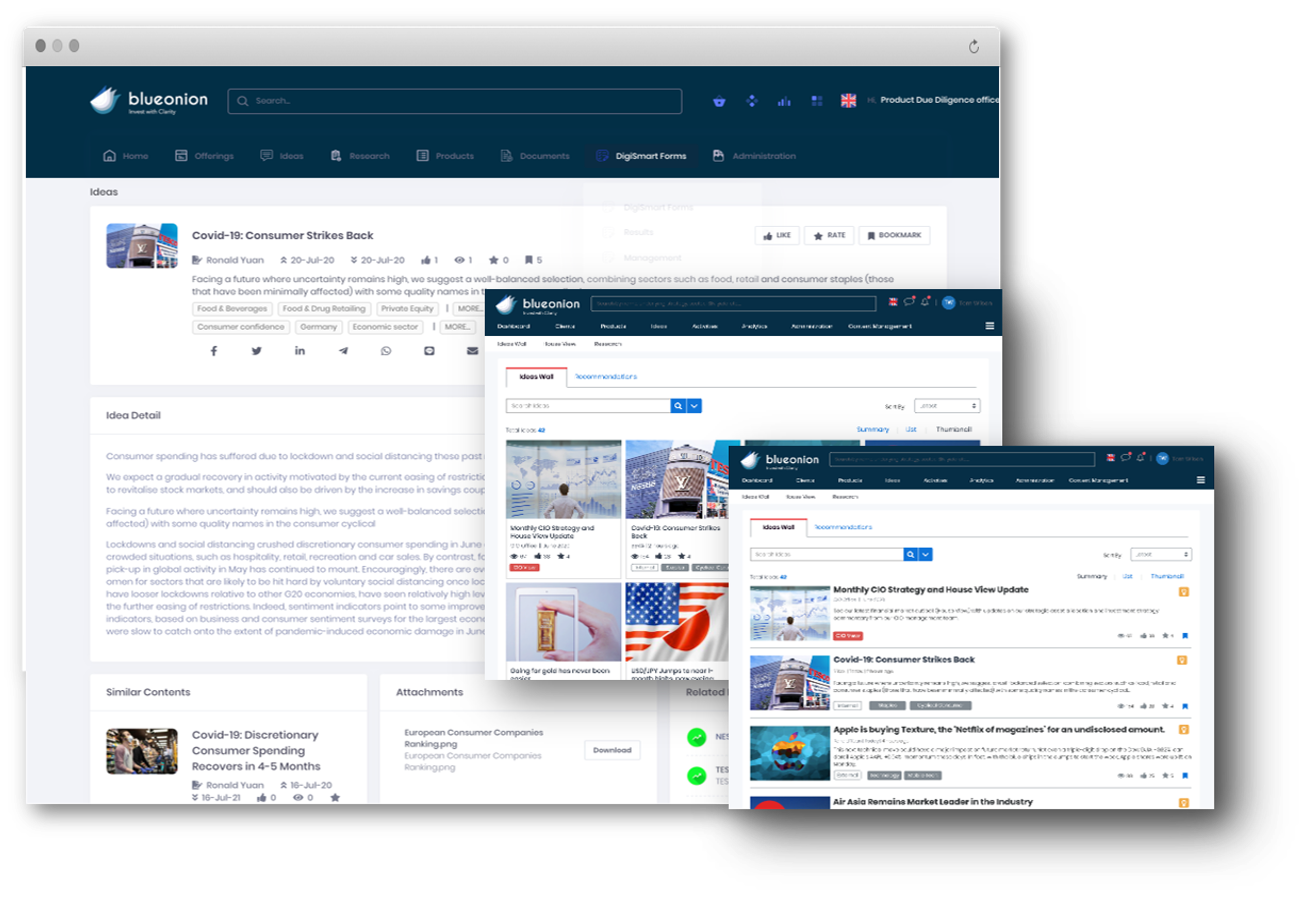

Research and Ideas

Exclusive gatekeeper access to award-winning strategies packed with videos, documents, research, reports, ideas, and themes related to the fund.

P2P Commentaries

A collection of commentaries and observations shared by asset owners, gatekeepers, and consultants for peer assessment. A must-read before onboarding.

Gatekeeper Forum

A highly curated forum that connects the buy and sell-side of funds and empowers gatekeepers to look under the hood before they invest.

Get in touch

arrange for a guided

BlueOnion tour

Schedule a Guided Tour Today!!!

Our Blog

Check Out

Our Latest Articles

Elsa Pau of BlueOnion discusses how asset managers can untangle the mess

This content is password protected. To view it please enter your password

盡職治理及負責任投資. 拍攝日期2022年 BlueOnion行政總裁 Elsa Pau, 周尚頤博士 Christine Chow, PhD 及戴潔瑩博士 Agnes K

Stewardship & Responsible Investing with Dr. Christine Chow & Dr. Agnes K

BlueOnion’s Chief EC.ESG Investment Strategist Dr. Agnes K Y Tai was invited

BlueOnion’s Chief Sustainability Officer Dr. Jeanne Ng discusses challenges in adapting to

BlueOnion's Chief Sustainability Officer Dr. Jeanne Ng was recently featured in a

Founder and CEO Elsa Pau joined industry experts in discussion of key