Gatekeeper Workbench

Integrated solution for

product due diligence

Meeting regulatory requirements and unlocking the last mile to enhance client and advisory relationships.

We understand the challenges facing the banking and advisory environment, with the product due diligence (PDD) requirements and regulatory scrutiny that has intensified over the past few years, making the digitization of this crucial process in the product supply chain a must-have.

For the firm to compete and meet increasing interest and demands from family offices, ultra-high and high net-worth individuals in Sustainable and ESG related investments, it is a requirement for banks and advisories to screen and exclude assets that misalign with the families or the investors' value system. By Integrating the Bespoke Gatekeeper Workbench between fund houses and the bank or the advisory, you are giving RM an extra mile to integrate the customer experiences with the advisory process, helping the firm differentiate.

Qualitative and ESG Screening

Product Due Diligence Workflow

Product Catalog & Profiling

Live Gatekeeper Community

Streamlined Process

6-Modular

Gatekeeper Workbench

01. Multiple Screening

Forward-looking data in Sustainability and Qualitative

02. Initiation

Set up a dashboard and invite managers to start pitching

03. Tracking

Tracking submission status and see progress %

04. Onboarding

Approve, comment, park, or reject a fund

05. Indexing

Manage all approved funds list in “My Product Catalog”

06. Monitoring

Hold managers accountable with over 100+ key indicators

Fund Screening

Multi-Dimensional

3 lenses of Filtering

Unlike other research platforms, BlueOnion features detail subsets of backward-looking quantitative data, forward-looking team practice data, and impact-driven sustainability data. BlueOnion’s advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on a universe of 300,000 active, passive funds and ETFs and 40,000+ companies, using 250 ESG metrics from 30,000 sources in over 170 countries. The highly visual platform allows you to perform comparisons between favorite groups of funds efficiently.

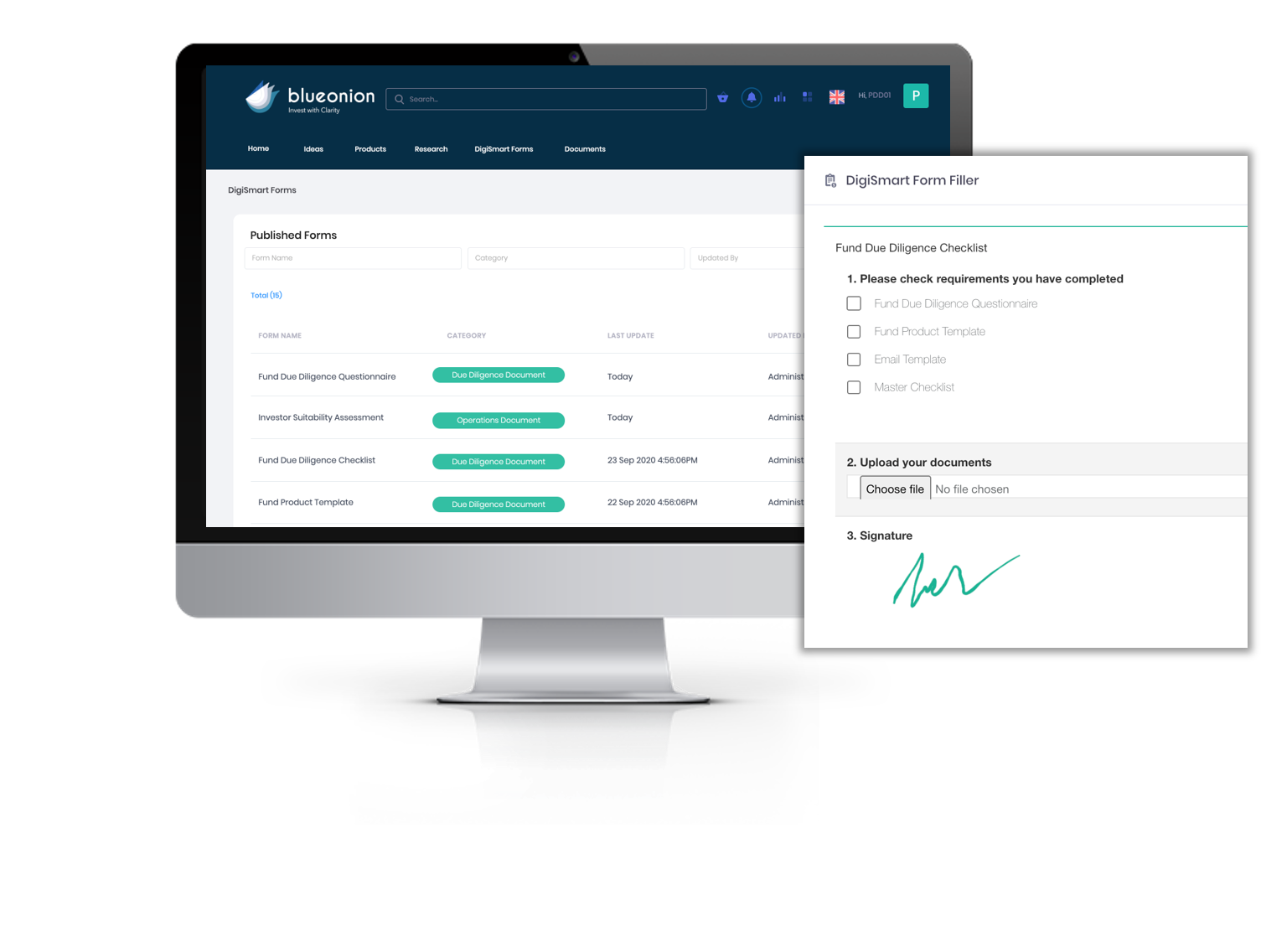

RFP Initiation

Fund House Pitching

Process Begins

Set up your team dashboard and invite fund houses to pitch by following your requirements and checklist for submission such as DDQ, suitability documents, key fact statements, etc… Access the BlueOnion’s full sets of DDQ and integrate them with your in-house metrics, e-signature, documents, submission, multi-format, logic, submission tracking, due diligence process tracking, EO PDD checklist, etc.…

Tracking

Dashboard Panel to

monitor progress

A dashboard view of fund houses’ due diligence document submissions and the tracking of submission status. Review the Multi-Format/Logic Digital Questionnaire, add comments to incomplete forms. Receive a notification when a document is received, see submission progress % of completion from the fund house, and automatically receive reporting when the entire DDQ process is completed. Approve or reject a fund or comment for future improvement.

Onboarding

Decision Making

To approve or reject

Upon approval of a mandate, export the due diligence reports, set up digital forms and templates for AR analysis templates, share class, launch emails, and pre-trade in excel or PDF. Set frequency for the fund house’s reporting and receive notifications when the documents are received daily, weekly, monthly, etc. A dedicated page is provided for each fund onboarded with a summary, ideas, research, videos, and the bank’s internal commentaries regarding the advisory team’s fund to sell.

Indexing

Manage listings in

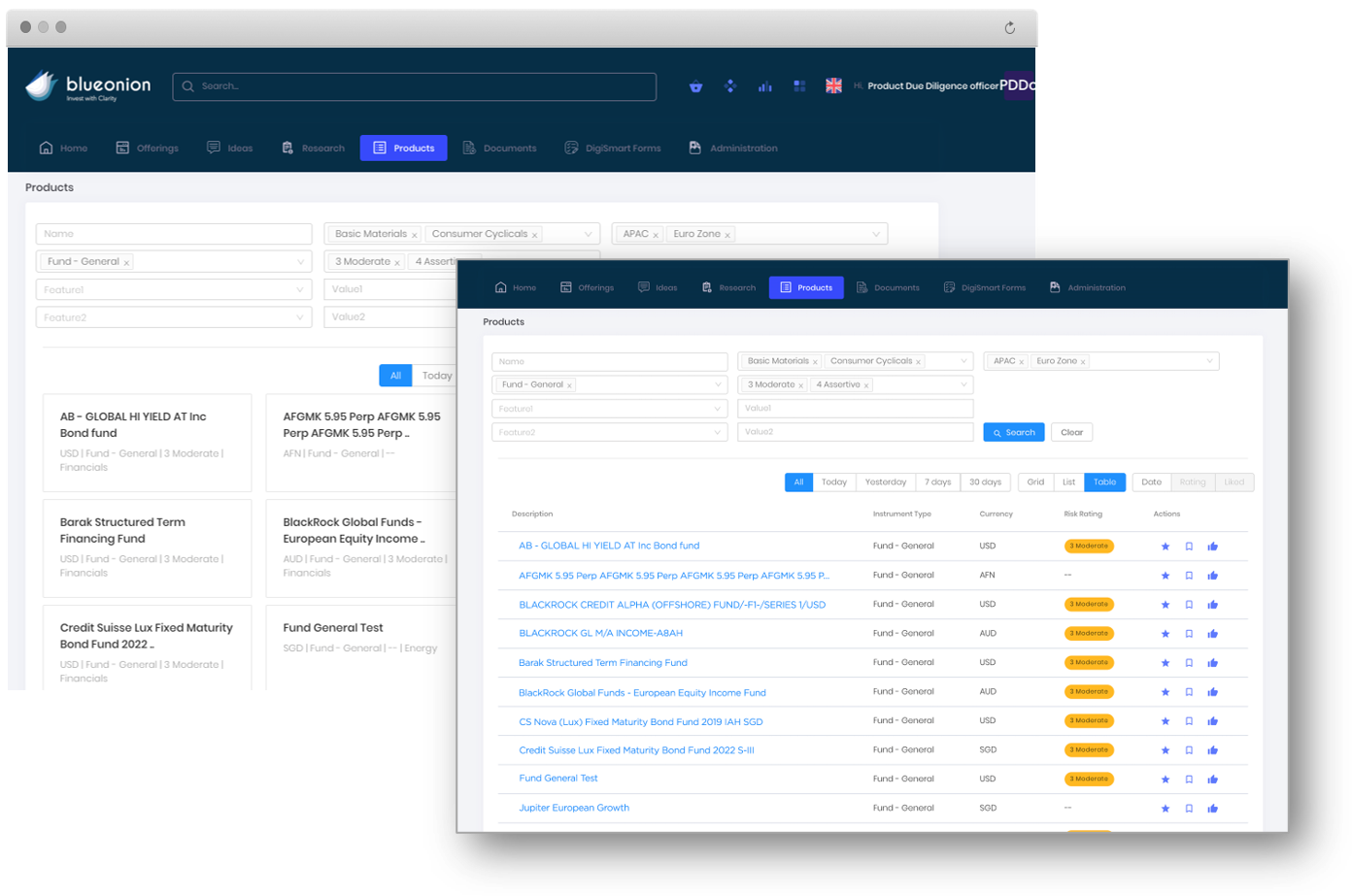

My Product Catalog

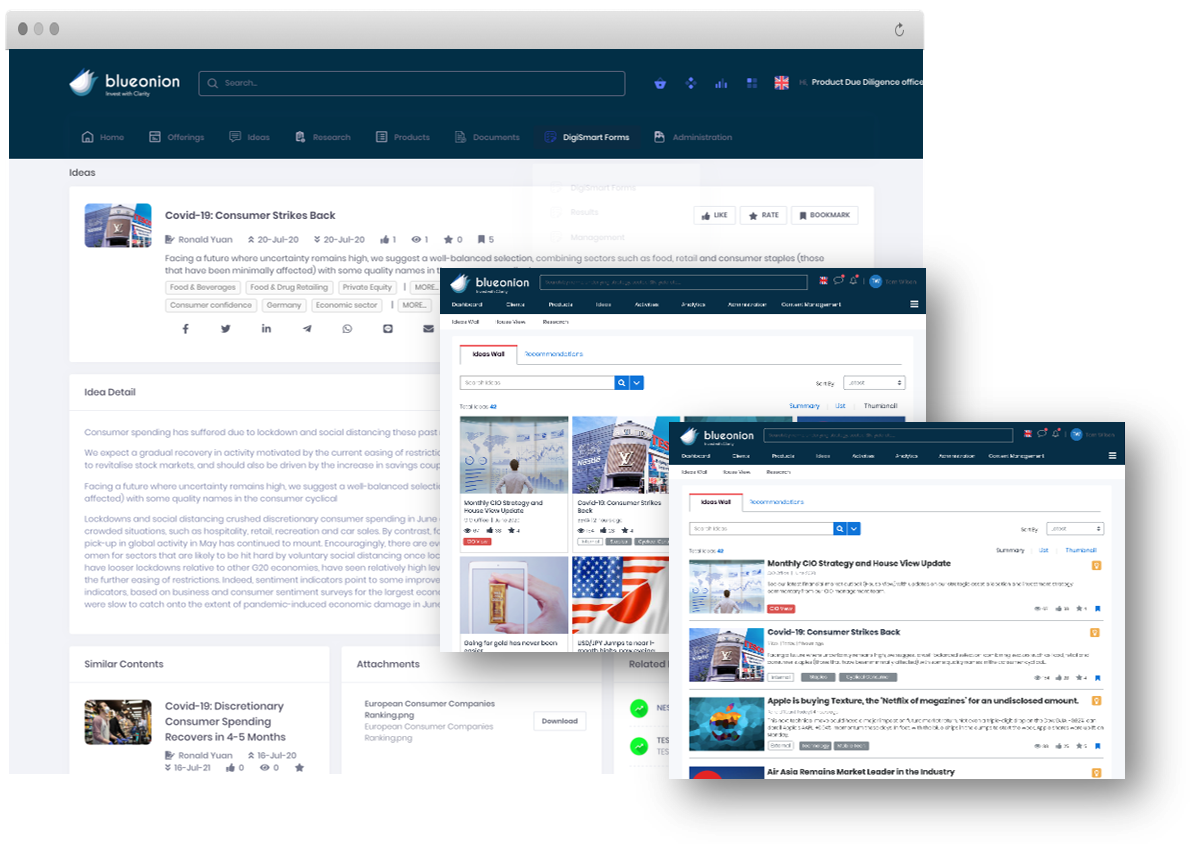

Manage all approved funds list in “My Product Catalog” and search by asset types, region, risk profile, themes, investment styles, etc in tiles or list views. Access the product key fact page with supporting narratives, documents, ideas, and research. Incorporate house views and commentaries to the key facts page and provide an extra mile for RM and the advisory team.

Ongoing Monitoring

Hold the Managers

Accountable for Performance

Stay focused and hold onboarded asset managers and their funds accountable while monitoring shortlisted portfolios on the go. Access the snapshot of funds along the three dimensions of performance and risks, qualitative behavior along five pillars over 48 key indicators, plus ESG, GC, and temperature alignment performance.

In the Media

Check out

Our Latest Media Coverage

Elsa Pau of BlueOnion discusses how asset managers can untangle the mess

This content is password protected. To view it please enter your password

盡職治理及負責任投資. 拍攝日期2022年 BlueOnion行政總裁 Elsa Pau, 周尚頤博士 Christine Chow, PhD 及戴潔瑩博士 Agnes K

Stewardship & Responsible Investing with Dr. Christine Chow & Dr. Agnes K

BlueOnion’s Chief EC.ESG Investment Strategist Dr. Agnes K Y Tai was invited

BlueOnion’s Chief Sustainability Officer Dr. Jeanne Ng discusses challenges in adapting to

BlueOnion's Chief Sustainability Officer Dr. Jeanne Ng was recently featured in a

Founder and CEO Elsa Pau joined industry experts in discussion of key